Fortitude Financial Group for Dummies

Fortitude Financial Group for Dummies

Blog Article

How Fortitude Financial Group can Save You Time, Stress, and Money.

Table of ContentsGetting My Fortitude Financial Group To WorkLittle Known Questions About Fortitude Financial Group.The Of Fortitude Financial GroupFortitude Financial Group Can Be Fun For Anyone

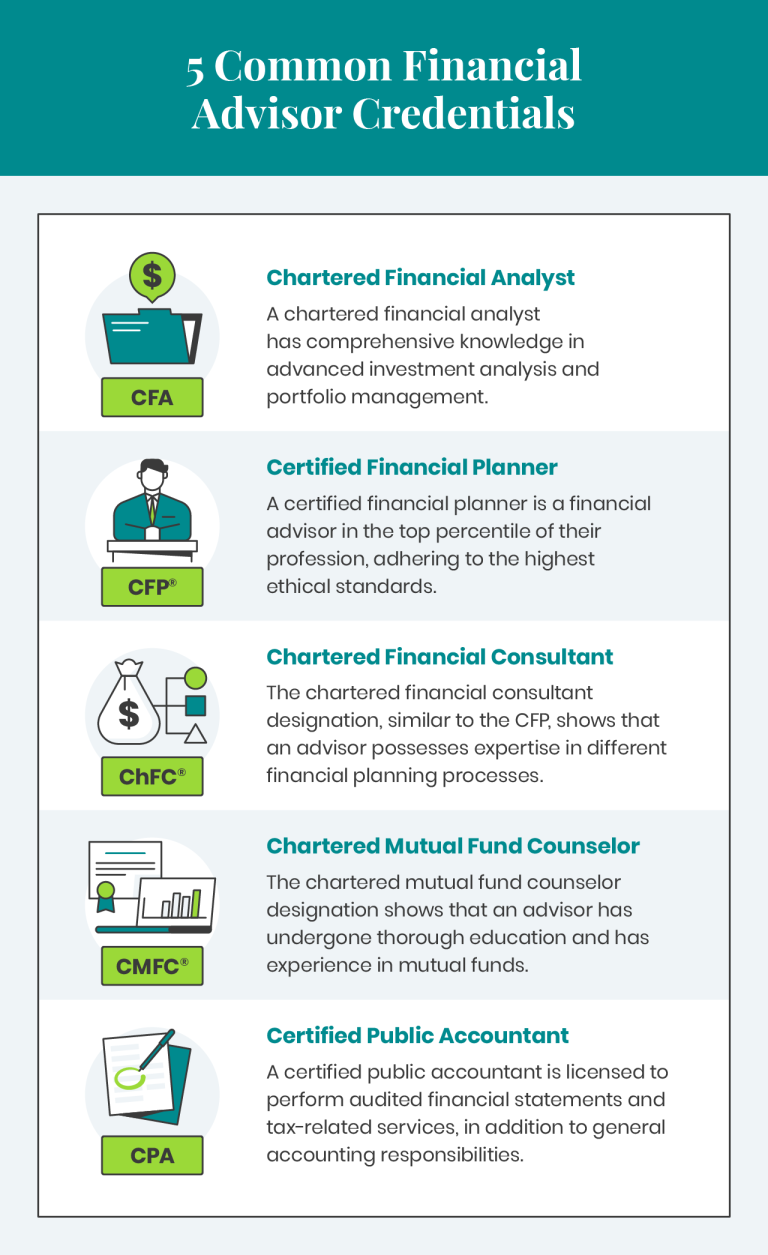

Some will examine your whole economic photo and help you establish an in-depth plan for accomplishing your monetary objectives. Others, however, will suggest only the products they market, which might provide you a restricted series of choices. Unlike various other occupations reviewed in this area, the financial preparation career does not have its own regulatory authority.An accounting professional that prepares financial plans is regulated by the state Board of Accountancy, and a monetary coordinator that's likewise an investment adviser is managed by the Securities and Exchange Payment or by the state where the consultant does business. If a coordinator you're considering uses a specific professional designation, look into that credential utilizing our Specialist Classifications lookup tool. Other planners may hold a credential that is far a lot more hard to obtain and to maintain, such as the CERTIFIED FINANCIAL coordinator classification, or CFP, provided by the Qualified Financial Planner Board of Requirements. This qualification needs at the very least three years of experience, enforces fairly strenuous standards to earn and keep, permits capitalists to verify the standing of any individual declaring to be a CFP and has a disciplinary process

An insurance coverage representative will tell you regarding insurance coverage products (such as life insurance policy and annuities) yet most likely will not discuss other investment choices (such as supplies, bonds or shared funds) - Financial Services in St. Petersburg, FL. You'll intend to see to it you totally understand which areas of your monetary life a particular planner canand cannothelp with prior to you employ that person

Fortitude Financial Group Can Be Fun For Everyone

Anybody can profit from expert monetary adviceno matter where they're beginning from. Our monetary consultants will take a look at your broad view. They'll think of all the what-ifs so you do not have to and guide you through life events large and little, like spending for university, acquiring a home, marrying, having a child, adopting a kid, retiring or acquiring assets.

I approximate that 80% of physicians need, desire, and should use a economic expert and/or a financial investment manager. Some financial investment experts such as William Bernstein, MD, believe my estimate is means too low. At any rate, if you wish to make use of an advisor momentarily or for your entire life, there is no reason to really feel guilty about itjust make certain you are obtaining excellent guidance at a fair cost.

See the bottom of the page for more details on the vetting. At Scholar Financial Advising we aid medical professionals and people with intricate financial requirements by giving economic suggestions click to find out more that they can apply on a hourly task or regular monthly retainer basis. Our experts hold at minimum a Ph. D. in Financing and Stephan Shipe, the company's lead expert, is likewise a CFA charterholder and CFP Expert.

Getting My Fortitude Financial Group To Work

With each other, we will browse the intricacy of everyday life by crafting a streamlined financial plan that is dexterous for your evolving demands - https://www.goodreads.com/user/show/181357412-cheryl-lee-morales. We will help you utilize your riches to release up time and power to focus on your family, your method, and what you enjoy a lot of. Chad Chubb is a Qualified Monetary Planner (CFP) and Qualified Student Lending Professional (CSLP)

He established WealthKeel LLC to simplify and organize the economic lives of medical professionals across the USA by custom-crafting financial strategies focused around their objectives and worths. WealthKeel is recognized by The White Coat Capitalist as one of a few select firms classified as "a great financial advisor at a fair price," for their flat-fee registration model and likewise their capped fee framework.

($9,500) for All. Collaborate with us if: You're retired or will retire in the next 7 years You have a total portfolio of $2M+ You're concerned concerning generating & protecting revenue permanently You intend to handle the 10+ key retirement income risks much more proactively You don't like troublesome cost frameworks (% of properties, flat yet tiered, commissions) We'll build you a personalized.

Excitement About Fortitude Financial Group

We can assist you create a savings and financial investment strategy, so you recognize where to put your additional income. We can likewise aid with different elements of your financial life consisting of financial debt administration (student financing planning), tax obligation preparation, and investment techniques. Our goal is to figure out the most efficient and flexible means for customers to construct riches and reach their monetary goals.

Physicians have special financial issues that can sometimes feel frustrating. As homeowners, others, and early-career doctors, you deal with squashing trainee car loan debt and completing monetary goals like beginning households and buying homes.

Report this page